Troubling Website Trends

National Merchants Association has identified some trends on Nutraceutical merchant websites that can delay the acceptance of merchant account applications.

Frequent Website Changes

Merchants not notifying NMA prior to making changes to websites.

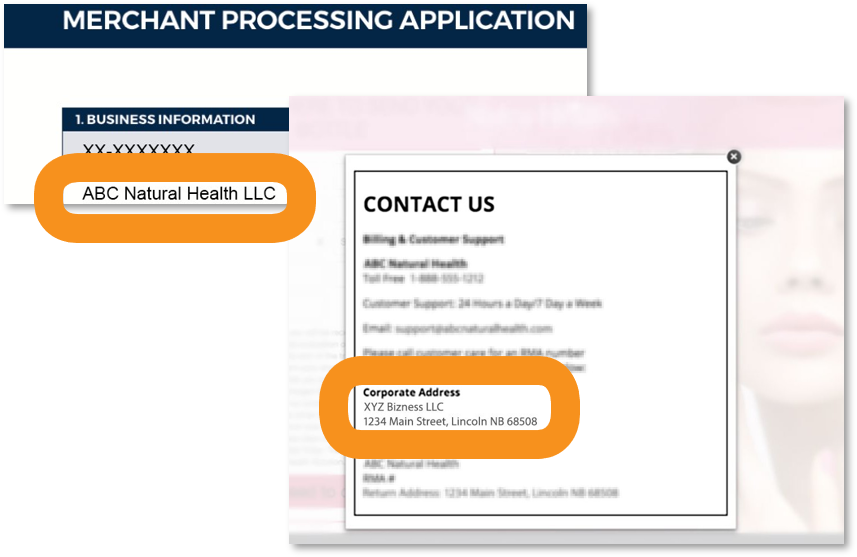

Name Inconsistency

Legal name and DBA names inconsistent across submitted documents and website.

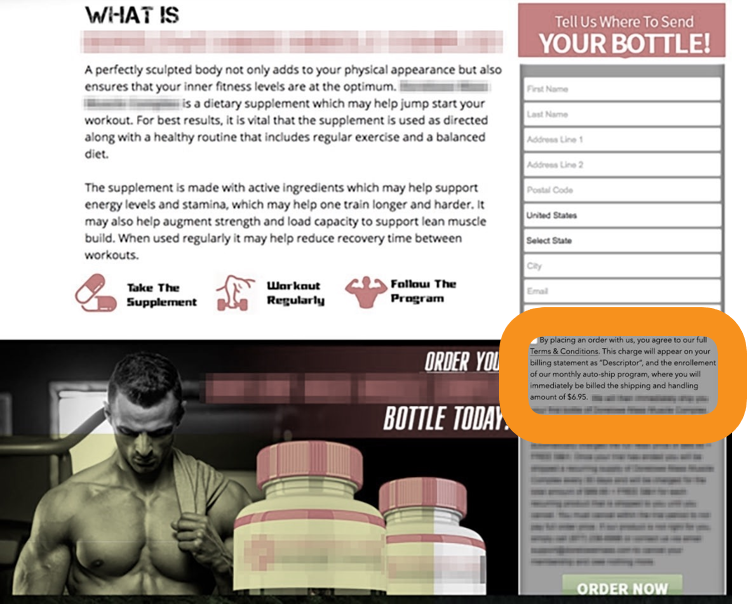

Nutra Site Inconsistency

FDA disclaimers and ingredient lists are noncompliant.

Card Brand Noncompliance

Site not meeting requirements for the card brand logos and drop boxes.