Trial / Continuity / Straight Sale

Business Agreements

Advertising Network Agreement ?

Advertising Network Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party Advertising Network

Advertising Network Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party Advertising Network

Customer Service Agreement ?

Customer Service Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party which handles customer service

Customer Service Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party which handles customer service

Fulfillment Agreement ?

Fulfillment Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party fulfillment/distribution center

Fulfillment Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third party fulfillment/distribution center

CRM Provider Agreement ?

CRM Provider Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third-party CRM Provider

CRM Provider Agreement

The contract between the merchantA business that accepts credit cards for goods or services. and the third-party CRM Provider

Merchant Processing Agreement (MPA) ?

MerchantA business that accepts credit cards for goods or services. Processing Agreement (MPA)

This is the agreement that outlines the merchant’s full range of services. To speed up the approval process, make sure this document is complete and signed

MerchantA business that accepts credit cards for goods or services. Processing Agreement (MPA)

This is the agreement that outlines the merchant’s full range of services. To speed up the approval process, make sure this document is complete and signed

Fraud Wrangler/Dispute Management Agreement ?

Fraud Wrangler/Dispute Agreement

Fraud Wrangler may result in instant approval

Fraud Wrangler/Dispute Agreement

Fraud Wrangler may result in instant approval

Negative Option/Continuity Addendum

Reserve Agreement

Identification

Driver’s License or State ID ?

Driver’s License or State ID

Verifies merchantA business that accepts credit cards for goods or services. identity and necessary for Know Your Customer(KYC)

Driver’s License or State ID

Verifies merchantA business that accepts credit cards for goods or services. identity and necessary for Know Your Customer(KYC)

Company

Previous Processing ?

Previous Processing

If the business has previously been set up with merchantA business that accepts credit cards for goods or services. services, provide 3 months processing statements

Previous Processing

If the business has previously been set up with merchantA business that accepts credit cards for goods or services. services, provide 3 months processing statements

DBA/Fictitious Name Filing (See note) ?

DBA/Fictitious Name Filing

If your merchantA business that accepts credit cards for goods or services. operates under an assumed name that is different from its corporate name aka (doing business as) DBA, trade name or fictitious name, your merchantA business that accepts credit cards for goods or services. may be required to register with the state, county or city in which it is located

DBA/Fictitious Name Filing

If your merchantA business that accepts credit cards for goods or services. operates under an assumed name that is different from its corporate name aka (doing business as) DBA, trade name or fictitious name, your merchantA business that accepts credit cards for goods or services. may be required to register with the state, county or city in which it is located

Proof of Foreign Entity Filing ?

Proof of Foreign Entity Filing

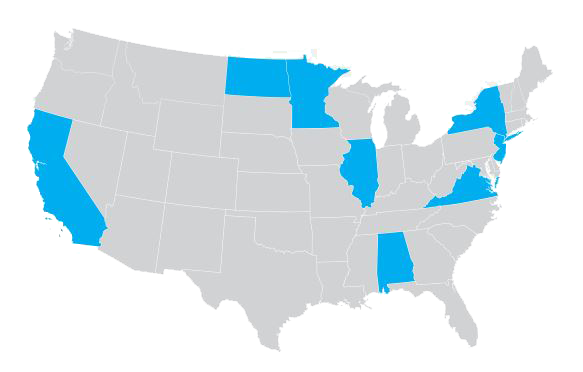

If your merchantA business that accepts credit cards for goods or services. Incorporated its business in one state (Delaware and Wyoming are popular choices because of their business-friendly practices) and operates some or all of its business in another state, your merchantA business that accepts credit cards for goods or services. will likely need to register it’s business as a “foreign entity” or “foreign corporation” in that other state. This is also known as a “foreign filing” and can be applied for through their Secretary of State’s website. The states listed (highlighted in blue on map) have been identified as states that require Foreign Entity Filing

Proof of Foreign Entity Filing

If your merchantA business that accepts credit cards for goods or services. Incorporated its business in one state (Delaware and Wyoming are popular choices because of their business-friendly practices) and operates some or all of its business in another state, your merchantA business that accepts credit cards for goods or services. will likely need to register it’s business as a “foreign entity” or “foreign corporation” in that other state. This is also known as a “foreign filing” and can be applied for through their Secretary of State’s website. The states listed (highlighted in blue on map) have been identified as states that require Foreign Entity Filing

Alabama

California

Illinois

Minnesota

New Jersey

New York

North Dakota

Virginia

*Additional information may be requested